From cash-negative liability to profitable HMO asset!

For more than 10 years, what was once the office for a mortgage broker business in Gillingham, Dorset, has been standing empty. Only now, with the benefit of experience gained in professional HMO development as a Franchise Partner with Platinum Property Partners (PPP), has Ben Gould been able to turn a cash-negative liability into a profitable asset.

But it hasn’t been an easy journey…

Steeped in history

Dating back to 1516 when Henry VIII was on the throne, this Grade II Listed high street property certainly boasts historical importance.

Ben commented: “It was apparently the first free state school in Dorset and remained a school until 1860. Throughout the Victorian era and into the 20th century, the building was used as retail premises and still had a Victorian shop front when we acquired the building in 2001.”

Following the closure of his business in 2008, Ben tried to both sell and rent the property, but it was a tough market. High streets up and down the country were dying and the financial crisis had halted growth or movement for many businesses.

Change in law, but no change in vision

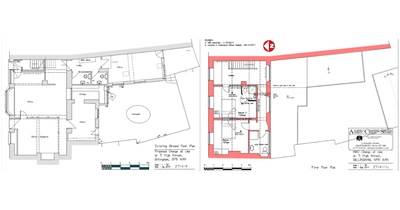

Despite its quirky character and 140 square meters of space, no potential buyers came forward so in 2013, Ben approached an architect about turning it into a house. With homes in short supply, the Government had recently changed the law to allow the conversion of commercial properties to residential dwellings under permitted development. While planning permission would still be required due to the property being Grade II listed, Ben was hopeful the application would be successful.

“It was coming on for five years since we’d used the property full time; the roof was leaking and there was no demand from buyers or leaseholders,” added Ben. “But the local authority rejected the plans and said we needed more proof that the property was unwanted. They had this vision of an artisan living upstairs and making and selling things downstairs. It was such an old-fashioned view and they needed to accept times had moved on.”

The property was marketed for 18 months with no interest as a commercial unit, shop or office. Two estate agent reports supported this, yet a second application was rejected at town, local authority and district council level.

It was now early 2016, and with the help of a local planning officer, Ben appealed. They put together a strong argument, highlighting that if the proposal wasn’t passed, it would be boarded up and left to rot – not good for the neighbouring florist and pub. The local and district councils were damned for their rejection of the proposal and thankfully, it was eventually approved. Ben now had the option to sell the commercial property with planning permission to convert it into a house. This was real progress, but as Ben had no appetite to do the conversion himself, he was still struggling to sell.

The HMO challenge

At around the same time, Ben had discovered PPP. In January 2017, he joined the franchise and began his HMO journey, purchasing and converting two homes into highly profitable professional HMOs in Bridgewater. All the while, his commercial property remained a liability, but he now had the drive and the knowledge to explore converting it into an HMO asset.

“We continued to use the consultant we had been working with and went all out, applying for a double occupancy HMO,” said Ben. “It was a real challenge to get it passed but essentially, conservation didn’t want the building to become an eye sore or fall down. Opinions on the planning committee had also changed, and they accepted that the town wasn’t a thriving commercial centre and people needed somewhere to live.”

Planning permission was granted in July 2018, but with over 40 conditions to be met including the placement of electrics, vents in the bathrooms and which original timbers would be cut. Approval from conservation followed in December 2018.

The HMO dream

Had Ben been a Franchise Partner with PPP earlier, he would have saved over £12,000 on planning consultancy fees, but just being part of the network has paid dividends in other ways.

“We were so far into it before I joined PPP, that it made sense to stay with the existing planning consultants,” added Ben. “However, without the knowledge I have gained from PPP, I would never have considered, nor had the expertise, to convert the property in the first place. It would still be standing empty and possibly derelict, costing me money.

Work is now well underway to convert the commercial property into a five-bedroom high-quality professional HMO for double occupancy, with the added benefit of a shared courtyard. The property will make a beautiful character home for up to 10 tenants, although Ben is likely to let it on a single occupancy basis in the first instance.

Watch this space for a special before and after spotlight on the property!